Roamly RV Insurance Compared to Progressive

In this post we’ll show the results of Roamly RV insurance compared to Progressive. Please understand that Roamly acts as an insurance agency, using major companies as underwriters, while Progressive is a single insurance company and underwrites their own policies.

This means that when you request a quote from Roamly, they will compare coverages from several companies. Progressive offers its own coverage only.

As consumers, it’s always in our own best interest to research whatever company we decide to go with before signing on the dotted line. Most people rely on AM Best, the largest credit rating agency in the world specializing in the insurance industry and easily found online.

We have our 30 year old motorhome insured through State Farm Insurance, bundled with our home and auto policy. It’s for liability only because at this age, we figure it ain’t worth much. Our premium is $120.03 per year. They know we use it only a few times a year and it sits covered in our driveway for the winter. That’s a pretty reasonable rate.

But what if your RV is your permanent residence, or you want to rent it out to make some extra cash? What if you can’t bundle your RV insurance with a bunch of other types of insurance? Maybe you have poor credit or a traffic accident in your recent past. And what if you converted your van into a campervan yourself?

Roamly is an insurance agency owned by Outdoorsy. According to their advertising, Outdoorsy is the largest and most trusted RV rental and experiences marketplace on the planet. They want you to list your RV for rent through their service. Why? They make money and you make money. Note: As an affiliate, we make a few bucks too.

What Makes Roamly Insurance Unique Compared to Progressive

Tiny Tiki Retro Hideaway located in the mountains of California near Chatsworth. Available for rent through Outdoorsy. Click on image to see more.

Besides being less expensive than the major RV insurers, Roamly has two unique features that might make it the perfect insurance choice for you.

- Roamly policyholders are free to rent out their rig without breaking the terms of their policy.

- Roamly offers coverage for all RVs, including unique inventory like DIY, as well as uplifted Class B’s and camper vans.

These two unique features can be huge if you are trying to get reasonably-priced RV insurance. The fact that you can keep your coverage while renting out your rig is the icing on the cake.

Progressive Insurance

Progressive insurance is one of the largest insurers of RVs. They have a very inexpensive, entry level policy. However, Progressive only insures professionally-converted campervans. They do not insure DIY campervans, and they won’t cover you if you rent your RV to someone else.

I Compared Roamly RV Insurance to Progressive Insurance

Comparing insurance coverages is challenging, to say the least. The information they provide online is general and incomplete. Obtaining a clear, concise quote requires you to furnish detailed information on your rig by phone interview. It can be done, but I found a way to get a general idea by using Progressive’s and Roamly’s online quote tools, using the same search parameters each time.

For my comparison I said I had a 2023 Minnie Winnie, 23′ with no slide-outs. I said it was for “pleasure use”, 28 days/yr or less. I stated I was the original owner, that I owned my own home, and estimated the value (using RV Trader) at 95k.

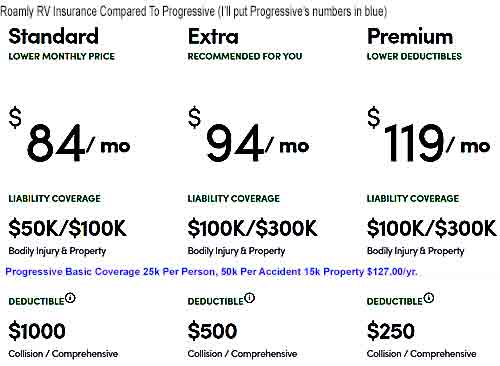

Roamly gave this as a quote:

- Standard: Lowest coverage limits and highest deductible, with the cheapest rate.

- Premium: Highest coverage limits and lowest deductible, with the most expensive rate.

- Extra: Falls in the middle of Standard and Premium. This is the policy that’s “recommended” by Roamly.

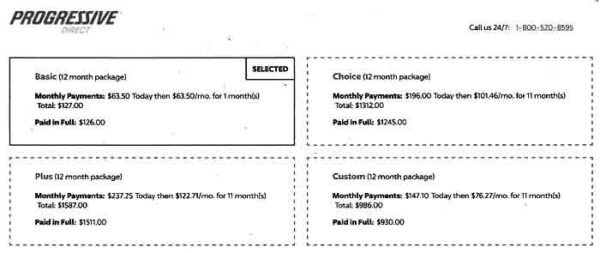

Progressive Insurance supplied this:

Even though very little information is provided by either company, we can see that the Roamly basic plan is less than the Progressive Insurance basic plan. I couldn’t even get information of the Progressive plans’ deductibles.

Full Time Living

Roamly’s full time living premiums were $102.00, $113.00, and $140.00 per month, respectively, when I told them my RV was my full time residence. I could not get any further details without a phone call to an agent.

Progressive premiums were $134.00, $115.91, and $140.40 per month, respectively. Their basic plan is liability only. Their mid-price plan covered roof and pest damage, total loss replacement, and some other good coverages.

Roamly offers total loss replacement if the RV is less than 5 years old. They offer the same coverages as Progressive. To get the details, I would have been required to talk to an agent.

Roamly RV Insurance Compared to Progressive Conclusion

It looks like both companies offer very similar coverage for comparable prices.

With Roamly you can add roadside assistance. Progressive refers you to a company called Agero.

Both companies offers home and auto insurance bundling options that can help you save.

Roamly insurance is underwritten by larger and more established insurance companies, including Safeco Insurance, Foremost Insurance, Voyager Indemnity Insurance Company and Allstate, among others. You can not choose who underwrites your policy.

Among the usual discounts Roamly offers a discount to military personal.

Roamly’s Claim to Fame

Roamly has two advantages that make them unique:

- Roamly policyholders are free to rent out their rig without breaking the terms of their policy.

- Roamly offers coverage for all RVs, including unique inventory like DIY, as well as uplifted Class B’s and camper vans.

- Roamly will also offer insurance by the day to your renters.

Availability:

Roamly is available in most states except Florida, Hawaii, Kentucky, Louisiana, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Dakota, Rhode Island, or Vermont.

*I have endeavored to give you the most accurate information I could find.

Let Us Know Your Experience

Let us know your experience getting insurance for your RV, DIY conversion, skoolie, or other unique builds in the comments below.

Leave A Comment