![]()

In this blog post we wanted to share our 30 year journey of home ownership ending with owning our current small house with no debt or mortgage. We also wanted to encourage you in your journey, as well as share the in’s and out’s we learned along the way.

Well, it turned into a massive undertaking whose length and topics are far beyond most folks attention span. So, I did the unthinkable and split it into three separate posts using color coded text to keep the three sections straight.

Here’s are the main topics:

- Understanding Tiny Home Ownership: Tiny vs. Conventional (black text color).

- How We Achieved Home Ownership (green text).

- Getting People To Lend You Money (purple text).

Understanding Tiny Home Ownership: Tiny vs. Conventional

It’s all led up to this moment. You’re sitting at a conference table in the bank or title company with your mortgage lender. They hand you a nice pen. You hope you understand the giant stack of papers you reviewed yesterday, because you’re about to sign and initial every page. Your life is about to change forever.

You’re buying your first home.

If you’re purchasing an existing home on a foundation, you’re in a realm familiar to realtors, lenders, insurance agents, title companies, local utilities, and everyone involved in the process. There are countless laws and regulations governing the transaction, protecting both you and the lender. They all understand what’s happening. They also want you to understand what’s happening, because it’s in everyone’s best interest.

Now for a moment, let’s pretend you’re buying a tiny house. Does everyone at the table still understand all the rules and regulations? Do you?

Here at Tiny Life Consulting, we have several pages on buying or building tiny houses with the ins-and-outs of construction, location, utilities, permits, codes and zoning, etc. The purpose of this page, however, is to focus on the investment.

If this tiny is off her wheels and fixed on a permanent foundation, you probably have a real estate deal in the works. If she’s not, the most important question for you personally relates to the quality of this purchase as an investment.

Is The Land Included in the Deal?

If so, this is probably a real estate transaction. Below we’ll describe how we went from employee housing to buying our first house, building equity, and eventually cashing out to own a small home outright in retirement.

If the land is NOT included, and the structure is on wheels, yours is a different situation. It may be titled as an RV, a mobile home, or a vehicle. That doesn’t mean it won’t appreciate- it may or may not, dependent upon many factors. You will probably still have a loan. Visit the Building and Living Legally in Tiny Homes page for help on the legalities.

Land or no land: what difference does it make?

The Big E: Equity. “Home equity is the market value of a homeowner’s unencumbered interest in their real property; that is, the difference between the home’s fair market value and the outstanding balance of all liens on the property” -credit Wikipedia.

Simply stated, the difference between the value of what you own, minus what you owe, is an asset that cannot be underestimated. For most Americans, buying our first real estate is the way we start really saving money. It’s harder to do now than it was when we were young, but it’s an important consideration as you plan on where to plant your tiny house. Structures rarely increase in value; land usually does.

How We Achieved Home Ownership

Stepping Stones to Owning Our Home Outright

Aspen Employee Housing

When Rachel and I married forty years ago, we had a great living situation through employee housing in Aspen, Colorado. We didn’t own anything, but we had great jobs, low rent, and a staggering naivete about financial matters. Only learning that our second child was on the way set us on the road to buying our first house. Learning about collateral, down payments, credit, mortgages, escrow, insurance, property taxes, maintenance, depreciation, and other realities slapped us upside the head harder than having two little kids underfoot. Fortunately, this was a long time ago. We had our shot, and we took it. We had no way of knowing how fortunate we were, even though the only house we could afford was quite a distance from our work.

The American Dream and Today’s Realities

When we bought that first house, the “American Dream” still seemed attainable. The Oxford English Dictionary defines the American dream as “the ideal that every citizen of the United States should have an equal opportunity to achieve success and prosperity through hard work, determination, and initiative.” Now I realize this ‘ideal’ was truer for some than for others. Still, real estate can be a great investment. Our first house was the most solid business decision we ever made, even though we were too inexperienced to realize it at the time.

I wonder who really has the chance to attain the American Dream these days. In the thirty-plus years since we bought our first house, wages have risen slightly, but the cost of housing has risen exponentially.

How, then, can anyone starting out in life amass the enormous chunk of change necessary to make a down payment and qualify for a mortgage?

Before giving up on your own American Dream, let’s take a look at every major aspect of the process. The more you understand, the better your chances of getting a toehold in the world of home ownership.

First, let’s look at tiny homes.

The Big Decision: Finance Just the Structure, or Structure Plus Land?

You’re buying or building a tiny home! That’s great. But probably the more important decision you will be making is whether or not you are also buying the land on which it will sit.

Real Estate Appreciates. Do Tiny Homes?

Whether your tiny home investment will appreciate or depreciate depends on how it’s built and where it sits. If it is built to RVIA standards, sits on a trailer, and is easily moved, it will depreciate like any RV. It’s considered a vehicle.

If your tiny home is built to IRC codes and permanently affixed to a foundation, it will be considered real estate and appreciate like a regular home. Note, however, with rules for tiny houses still in flux, it’s best to check with your county’s zoning officer to see what they require. In our town, Pagosa Springs, THOWs are only allowed as ADUs, must be on a permanent foundation, and connected to the main home’s utilities.

In my mind, if you are going to have to have a permanent foundation it would be less expensive to build a small tiny home right on the foundation instead of buying a trailer and then trying to retrofit it to a foundation.

Understanding the Basics of the Home/Real Estate Buying Process

What I wish we had known:

Buying a home is as much an emotional decision is it is a financial investment. This is not necessarily a good thing. Your realtor isn’t going to tell you this. Their goal is to make money. It’s your job to get educated about the investment you are thinking about making. But the dream of no longer renting and finally having a place to call your own is a powerful draw. Do as much research as you can, then make the best (non-emotional) decision you can make.

What I wish we had known:

The structure is not the investment; the land is. Sure, the structure is worth money. Even if you are planning to live tiny in your own home on someone else’s property, there may still be value in your tiny. See “Real Estate Appreciates: Do Tiny Homes?” above. But know this: land generally appreciates. Structures generally do not.

Tiny Homes As Collateral

Whatever you are buying will become collateral for the loan, whether it’s just the structure or the structure plus the land. If you don’t make the mortgage payments, the lender will take possession of whatever you have financed. This has been an issue for tiny home buyers until just recently.

Lenders are just now beginning to believe in the value of a tiny home on wheels. Until now a THOW (tiny house on wheels) has been considered a vehicle like an RV. That’s fine if you’re applying for a vehicle loan. Putting a tiny home on a permanent foundation changes everything, and it becomes real estate.

Getting People to Lend You Money

In the simplest terms possible, getting a mortgage is a money-making venture for the lender. Mortgage lenders make money by letting you use their money for a fee (interest), with the understanding that if you default on the loan, they’ll take your house away.

The reality is, they don’t want to have to take your house. They just want you to pay the loan. They really don’t want a lot of risk. The lower the risk, the cheaper your loan will be, meaning your interest rate will be lower than that of a high-risk borrower.

What does it take to secure a mortgage? We are not experts on this. There are countless good books on the subject. But simply put, you want to be a low-risk borrower. They want to know that you work and will keep working. They want to see that you live within your means, so you can make your payments. They want collateral, meaning that, in addition to this house they’re going to finance, they want to see that you have savings, and possibly a retirement account (probably through work).

Qualifying for a Mortgage

To get a loan for a home you must be able to prove you can repay the loan. Lenders look at your income via pay stubs, work history, and tax returns. They will run credit reports to learn about any debt you have, like a car loan, student loans, and credit card debt; credit reports also include details of whether or not you make your payments on time.

Of equal interest to them will be your assets, or things you own. Having a savings account shows a lender that you are responsible and can manage your finances. Savings accounts can include a 401K that was established by your employer.

Overview Understanding Credit, Savings, Record Keeping, and Employment History

Steady Income

Both of us had good long-term jobs working in the same department store. We were able to supply the bank with 5 years of tax returns showing our steady income.

If you are self-employed, they will want to see your tax returns for the last five years.

Great Record Keeping

Having a solid bookkeeping system is essential when talking to lending organizations. It impresses them that you know what you’re doing financially and easily shows your financial situation. Being able to show them a profit/loss statement is part of adulting.

My wife had taken accounting classes at the local college and became proficient in several accounting software programs like Quickbooks. Her bookkeeping abilities have given us a “leg-up” on every venture we’ve started. The banks were happy to see us.

Establishing Good Credit

As a young person, you can start building your credit in several ways. I bought my first car, a Mercury Capri, in 1970 brand new off the lot. My dad cosigned for the loan. I made every payment in full on time. My credit was good. Next I bought a mobile home and paid faithfully each month.

Having a parent cosign for a loan is a good way to start earning a good credit score. If that is not in the cards for you, another way to start is to open a store charge account at a store you frequent. I worked at a department store so the owner was willing to open a charge account for me. I paid off the balance every month.

Having an account with a utility company and paying the bill every month also builds credit. Next you can apply for in-store credit cards like Target, Walmart, Ace Hardware or Home Depot. You’ll need at least one credit account open and reporting to at least one of the major credit bureaus for at least six months to generate a FICO® credit score.

“Your credit history is the record of how you handle your money and debt. It includes information about your loans and credit card accounts that have been collected by the three major credit bureaus—Experian®, Equifax® and TransUnion®. When credit bureaus receive that information, they add it to your credit reports.” For more on establishing good credit refer to the Capital One website where this quote is taken from.

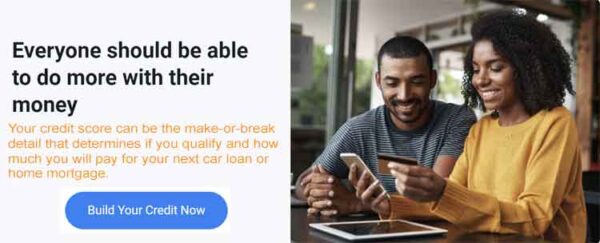

Credit Building Apps

In our app-driven world, you can sign up for a credit-building app that will offer you a small credit line. When you make purchases with the app, you pay off what you’ve bought and they report it to the credit bureaus every month. You can use it for things like groceries, which you’d buy anyway, and also set up autopay for your utilities and rent.

Kikoff is a credit-building service designed to help you build credit safely and responsibly. Their products are designed to target the 5 major credit score factors. There’s no credit check and your account is opened within minutes. They do offer a secured credit card in addition to a one year loan that triggers an additional credit building report. Kikoff is an official data furnisher to the 3 major credit bureaus: Equifax, Experian, and TransUnion. It’s $5.00/mth.*

Money Saving Apps

There are also apps that will help you save by transferring small amounts to your savings account with rules you set, like rounding up each purchase to the next dollar amount or transferring 50⊄ every time you buy a latte. Saving money becomes effortless and it impacts your credit score in a positive way.

Building Credit With A Secured Credit Card

Another beginning way to start a credit history is to open a “secured” credit card. A secured credit card requires a security deposit that acts as collateral for the credit card issuer. The credit card below requires a security deposit of just $200.00. They want their service to be accessible to everyone and that means no hard credit inquiry when you apply and no credit score requirement for approval. They report to the three major credit bureaus within one week.

Please note that we have provide a link to this Credit Builder Card as a service to you and are in no way connected to the company, bank, or loan office that issues the secured credit card. Refer to their Terms Of Service page for more details. Also refer to our Legal Stuff page for all the fine print.

Buying Our First Sticks-n-Bricks

When our second child was on the way, my wife announced that employee housing was out and house-hunting was in. We actually had a pretty sweet employee housing deal with very low rent. It was a 980 sq/ft modular home overlooking Aspen, valued today at $1.2 million.

There was nothing we could afford within twenty miles. I was not excited about commuting, especially mountain roads in the winter, but that was the reality of it.

A house in a subdivision we liked became available for $108k. We would need financing and a down payment. Our credit was good and an FHA loan was available, so we’d only need 5% down instead of the traditional 10%. When you have zero savings, 5% seems just as unrealistic as 10%. We looked for the money in our budget.

We cashed in an IRA our employers had established, and our tax refund was on the way. That left us about $1k short. I think that final amount came from giving up weed.

Good Bones

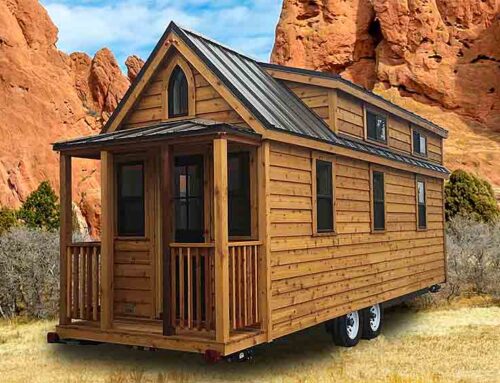

After thirteen years in our starter house, we needed a bigger place for our home-based business. Down the street sat a fixer-upper (shown at the top of the page). The occupants had all been sent to jail for having a pot grow in the basement. The DEA had kicked in every door. Dogs, cats, birds, and smoking had turned the interior into a toxic waste site. But, as they say, it had good bones. Using the equity from our first house, we financed this place as well as the funds it would take for repairs. It took several months to rehabilitate the home back to livable conditions.

During the fourteen years we lived there, we finished the basement and did major landscaping on the yard. When we retired five years ago, we sold it for almost double what we paid for it, using the equity to purchase outright the small place we now call home.

Understanding Mortgages and Loans

FHA Loans

An FHA loan is a government loan for first time home buyers. If your credit score is 580 or above you may qualify for a first time home mortgage with only 3.5% down payment. Buyers with a lower credit score can still qualify, but will need a 10% down payment. The government backing means that the interest rate is lower than convention mortgage rates.

There are no income requirements, but you must show that you have adequate funds to make the monthly payments and meet your other expenses. An FHA loan allows the seller to pay up to 6% of the closing costs where as a conventional mortgage the seller is only allowed to pay 3%.

This historic program brings home ownership within reach of millions of Americans who wouldn’t qualify for a conventional mortgage.

FHA Loans and Tiny Homes

In Colorado, tiny homes are now considered to be on the same level as manufactured homes (formerly know as mobile homes).

Any lender may make an FHA loan available for manufactured housing up to $69,678.00 for the structure and $23,226.00 for the lot (As of this writing Sept 2023). The FHA does not loan the money; a lender does. The lender is insured by the FHA against loss if the borrower defaults.

There are some other requirements you can see at the HUD website.

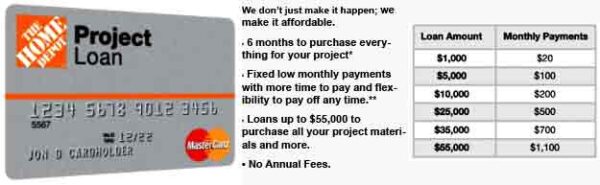

Project Loans

Try applying for a Project Loan from The Home Depot to finance your tiny home build. It is a credit card. It’s a great way to build credit as well as complete your project.

Starting a Side Hustle

My hourly wage when I started working at the department store in Aspen was $3.25. They also offered good health insurance, a ski pass, and eventually an IRA. I stayed at that job for twenty-one years, and the salary and benefits grew dramatically.

During this time I started doing service calls in the evening, on the way home, helping people with their TVs, audio systems, and internet. This went well. It proved there was a need for this service and the niche wasn’t being filled. It also proved easy for me to do.

Retail, however, takes an emotional toll. After two decades I needed a change. I worked for a year at a different company learning more about the home automation trade, but the owners were unscrupulous and it didn’t last. I sat on the back porch considering my options. We had grown accustomed to a decent salary, and even more accustomed to health insurance and retirement benefits. At first, things looked bleak.

Self Employment

The one thing I had was a degree in Avionics. Two years of classes taken over 40 years earlier still supplied me with basic electronics knowledge and the confidence to know I could do the job. Because I had done those side jobs in the evenings, I knew there were people who would pay me to solve their electronic problems.

Starting my own company was the best direction we could go, and Kevin’s Connections was born. Even though self-employment can be a risky venture, the business was successful and grew for 20 years.

One of the main reasons we succeeded was, again, good bookkeeping. My wife kept meticulous books. She learned about setting up a new business, applying for a business license and paying taxes. No one likes paying taxes less than I do. But Rachel insisted on sleeping at night, and looking over her shoulder for the IRS was out of the question. In the long run, we found that having run our business honestly paid off. Whenever we wanted to borrow money, our clean records paved the way. When we were ready to sell the business, the transaction went off without a hitch.

The Pros and Cons of Self Employment

Self employment was emotionally great for me. I worked my own hours, chose my own clients, and set my own prices. Those years weren’t great for my wife, however.

With small children at home, juggling a mountain of bills, doing the books for our business she worked seven days a weeks as fast as she could. In addition, she managed to have a company of her own doing books for others. She became so proficient at Quickbooks that she was frequently hired to clean up other businesses bookkeeping nightmares.

There were no more paid vacation days, but we still took vacations because we knew one day we wouldn’t be able to.

We used a credit card to buy all of the equipment for our clients and amassed enough miles for free or nearly free plane tickets every year.

Starting your own business or side hustle might be just right for you, but you need some skills. Check out the Freelance University below to see how easy they make it to gain these skills and avoid the mistakes.

Home University Newsletter Blog Directory Masterclass

Take the FREE Master Class: Take the Leap: Seven Pathways to Freelance Freedom After 50

Take the FREE Master Class: Take the Leap: Seven Pathways to Freelance Freedom After 50

During this timely Masterclass, you’ll learn:

- Three Powerful Mindset Traps holding you back from starting the freelance business you desire.

- Seven In-Demand Income Streams that offer the BEST opportunities in 2023 and beyond.

- A Proven 4-Step Pathway to help you achieve freelance success in the most efficient way possible.

Good Bookkeeping Was a Key

One constant through it all is that my wife has kept our books in perfect shape. I can’t emphasize enough how important that was for every aspect of our enterprises and adventures.

If you want to get ahead, I encourage you to learn the basics of bookkeeping and get your personal finances in good order.

For more information about learning good booking and even starting a booking business click here.

Refinancing

Our first mortgage rate was 9.5%. That was considered low at the time. As interest rates dropped we refinanced multiple times. If the interest rate drops more than 1%, it makes up in savings for the closing costs over the life of the loan.

Sometimes the refinance was to take advantage of lower interest rates, but often we added an amount of extra cash to make improvements, and to help send our son to college. Even doing that, by the time we sold and downsized we had enough equity to buy our third house for cash.

Retiring and Downsizing

For age and health reasons I had to retire. Because we could no longer bring in the amount needed to afford our home, we were forced to moved away. We were able to find a cozy corner of Colorado that had not yet been discovered and bought a small home for the equity we got from our previous home, just before the housing market went crazy.

Real Estate Worked For Us

The short story that took place over 40 years is that real estate worked for us. Yes, we started with good “blue collar” jobs and we did have a successful small business for 20 years. Of course, we made mistakes- everyone does. Still, the principles of saving money, living within or below our means, building good credit, and doing business honestly are some tried-and-true methods that have worked for millions.

Leave A Comment